How we invest

“All there is to investing is picking good stocks at good times and staying with them as long as they remain good companies.”

Warren Buffett

Investment Thesis

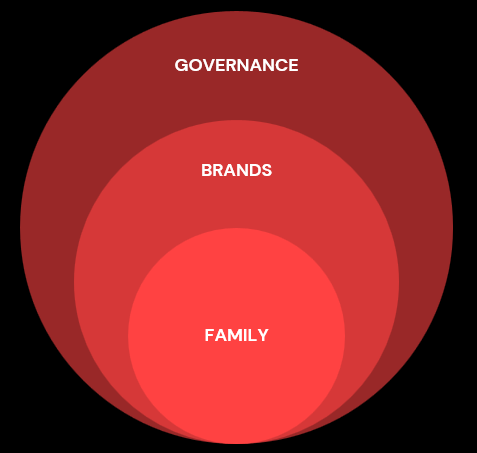

Families Outperform

Research backed by the Credit Suisse CS Family 1000 database shows that Family and Founder-owned businesses outperform, most prominently in Asia, among first and second generations.

Families are excellent capital allocators, investing for the long term, while avoiding excessive leverage - consistently outperforming nonfamily-owned businesses by 4 percent a year since 2006.

Brands Outperform

Strong brands outperform. Powerful assets are beacons of trust, and are resistant to inflation and disruption. National champions are being built while global brands are expanding their reach into new markets.

Governance Outperforms

Strong governance is a significant differentiator during times of drawdowns. Great companies which exceed regulatory requirements, win both the trust of consumers and investors.

Investment Approach

Investment Themes

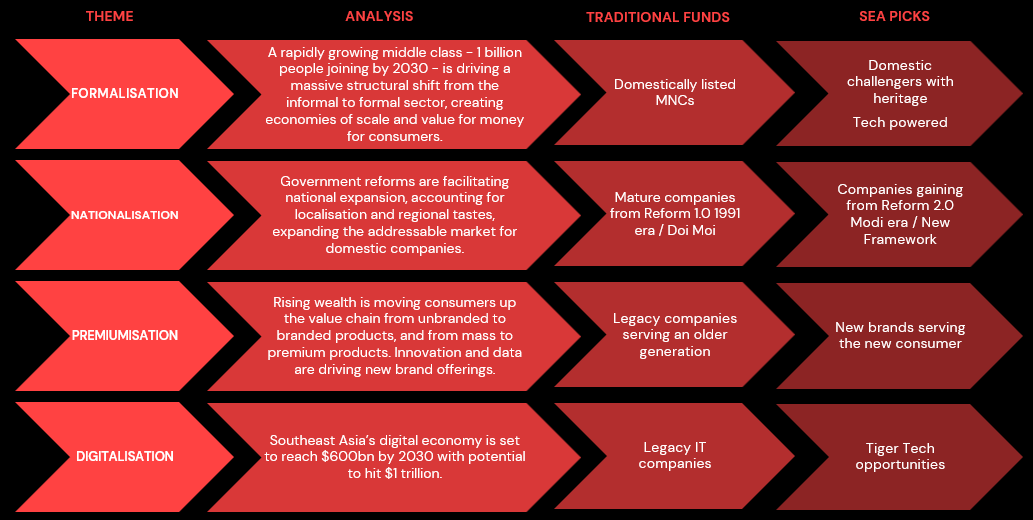

A rapidly growing middle class – 1 billion people being added - is driving a huge structural shift from the informal to formal sector, creating economies of scale and value for money.

Nationalisation

Premiumisation

Government reforms are facilitating national expansion, accounting for localisation and regional tastes, expanding the addressable market for domestic companies.